The stock market is a highly dynamic environment where prices are in a constant state of flux. This volatility is often considered a risk factor, but it can also lead to significant opportunities for those who understand market dynamics.

One of the most critical aspects of the stock market is trade settlement. Trade settlement refers to the process of transferring ownership of stocks from the seller to the buyer, along with the exchange of money. These settlements can take anywhere from a few minutes to several days, depending on the market and the type of stocks being traded.

Understanding trade settlement is crucial to successful trading, as it affects the timing and pricing of transactions. When buying or selling stocks, it’s essential to consider the settlement timeline to avoid liquidity issues or missed trading opportunities.

Another crucial factor to consider is market sentiment, which is a general feeling or mood among market participants concerning the direction of the stock market. Market sentiment can be driven by a wide range of factors, including economic indicators, political events, and global news. You can check stock market sentiment through the Fear and Greed index.

Investors must also keep an eye on market trends and patterns. By analyzing historical data, traders can identify patterns and use them to make informed investment decisions. For example, if a particular stock tends to rise in value during a specific time of year, a trader may consider buying shares during that period.

Present calculations are an essential part of trading, as they allow investors to evaluate the value of particular stocks and make informed decisions. There are many financial metrics to consider, such as price-to-earnings ratio, dividend yield, and market capitalization.

However, traders must remember that past performance is not necessarily indicative of future results. Economic and geopolitical events can significantly impact stock prices, and there is always a level of uncertainty in the market. Therefore, it’s critical to assess the risks and benefits of investment decisions carefully.

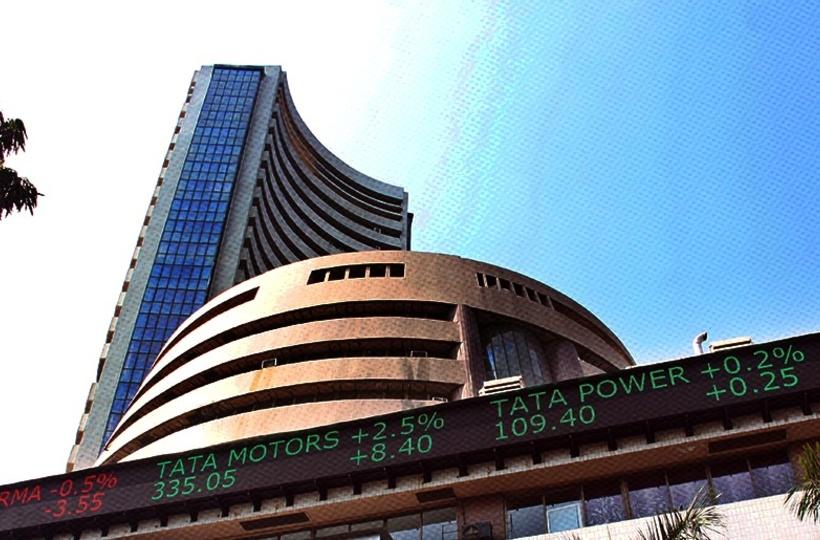

For those looking to trade in the Indian stock market, it is essential to understand the unique dynamics of this market. India’s stock market is among the fastest-growing in the world, with the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) being major players.

Investors must consider factors such as macroeconomic indicators, government policies, and currency fluctuations, as these can significantly impact the Indian stock market. Additionally, traders must familiarize themselves with Indian accounting standards and regulatory requirements to ensure compliance.

In summary, the stock market is a complex and dynamic environment that requires careful research and analysis to make informed investment decisions. Traders must understand trade settlement, market sentiment, trends, and financial metrics while keeping in mind the inherent risks involved.

While trading in the Indian stock market can present significant opportunities, investors must gauge all the pros and cons before making any investment decisions. It’s essential to work with a qualified financial advisor and stay updated on market news and developments.

Disclaimer: The above article is for informational purposes only and should not be taken as investment advice. Always speak to a qualified financial advisor before making any investment decisions. Trading in the Indian stock market involves risks, and investors must evaluate all potential risks before investing their money.